| KEY LEVELS | $ES | $NQ |

|---|---|---|

| Prior Range High (PRH) | 4358 | 14108 |

| Prior Range Low (PRL) | 4000 | 14000 |

| Prior Value High (PVH) | 4000 | 13977 |

| Prior Value Low (PVL) | 4278 | 13769 |

| Overnight High (ONH) | 4345 | 14068 |

| Overnight Low (ONL) | 4310 | 13912 |

| Overnight (ONPOC) | 4322 | 14000 |

| Prior POC (PPOC) | 4000 | 14000 |

| Initial Balance High | 4000 | 14000 |

| Initial Balance Low | 4000 | 14000 |

| Settlement | 4000 | 14000 |

| News/Impact Events: | High Impact: FOMC @ 9am EST |

| Overnight Inventory: | Opening Position: | Sentiment: | Direction: | Profile Open Type: |

|---|---|---|---|---|

| 100% Long | Inside Range/Above Value | Directional Conviction | Upside | Open Auction |

Trade Plan Breakdown:

Overnight Inventory is 100% LONG on ES and NQ this morning. At the time of writing, we are looking to open INSIDE Prior Range but ABOVE Value on Both Indices. When we open with this structure, it tells us that the sentiment is shifted to the upside and that directional conviction is the highest probability play as it stands. Based on our current positioning buyers are in control especially if we hold above prior value areas. When we open within range but out of value, we want to be very patient and look for clear signs the market is showing us either directional conviction or breaking back down into value for bracketing/ranging price action.

With that said, today I will be looking at the Prior Value Highs on ES at 4328.50 and on NQ at 13977. If price can move/hold above those levels and use them as support, look for a move back up towards the Overnight Highs and Prior Range highs and watch reaction there. If the Prior Value Highs don’t hold as support, look for price to move back down into the value area, likely targeting Prior POC and Prior VAL – Making sure to watch reaction at those levels.

Quick Scenarios:

- Upon open I will be looking for acceptance above Prior VAH’s on @ ES 4328.50 and 13977 on NQ.

- If we can hold above those levels, look for a move up towards the ONH + PVH and further upwards based on reaction.

- If we do not move/hold the Line in the Sand Levels and use them as support, look for ONI correction back down into value with a higher probability of testing PPOC and PVL

Summary:

| $ES Line in the Sand | $NQ Line in the Sand |

|---|---|

| $4328 | $13977 |

| $ES Upside Targets | $ES Downside Targets |

|---|---|

| $4345 | $4322.25 |

| $4350 | $4312.50 |

| $4358.75 | $4310.25 |

| $4365 | $4299.50 |

| 4384 | $4285.25 |

| $NQ Upside Targets | $NQ Downside Targets |

|---|---|

| 14032.50 | 13967 |

| 14068 | 13919 |

| 14108 | 13883 |

| 14128 | 13862 |

| 14157 | 13802 |

| Targets: | $ES | $NQ |

| Upside Targets: | 4384, 4365, 4358.75, 4350, 4345 | 14157, 14128, 14108, 14068, 14032 |

| Downside Targets: | 4322, 4312, 4310, 4299, 4285 | 13967, 13919, 13883, 13862, 13802 |

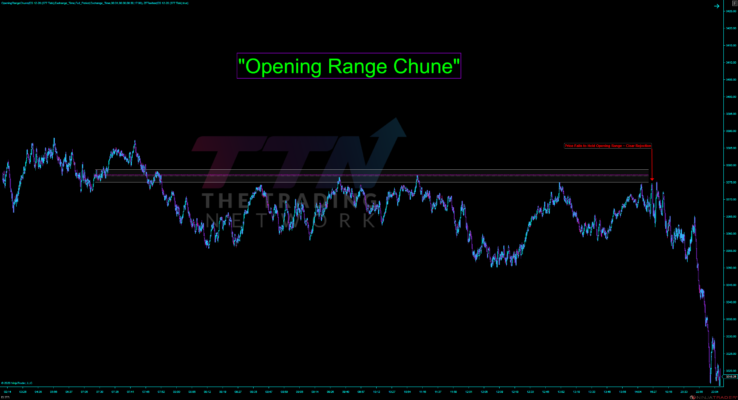

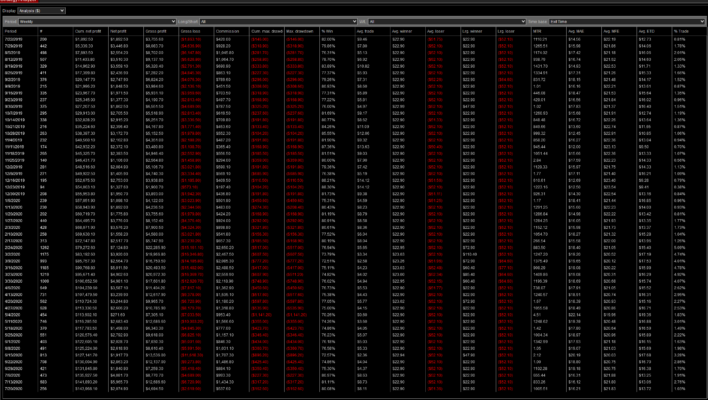

Chart Images:

ES Chart Images:

NQ Chart Images: